S&P 500 hits record high despite Trump’s attacks, investors stay unfazed.

The rapid-fire assault on bureaucracy, economic policy, and geopolitical affairs by U.S. President Donald Trump is not coming to an end. During high-level conversations with top U.S. officials and their Russian counterparts, Trump implied to reporters that Ukraine was somehow to blame for provoking Moscow’s invasion of the nation.

But Trump is ignoring the situation on other fronts. Strict regulations governing corporate mergers that were established during the tenure of former US President Joe Biden were maintained by his administration. Wall Street, which had anticipated a surge in transactions due to hopes that the Trump administration would be pro-business and less hostile to mergers and acquisitions, may be disappointed by that.

However, investors weren’t very disappointed by that. On Tuesday, the S&P 500 established a new closing record. In addition, the European Stoxx 600 reached a new high away from Trump.

Things you should know today

Both sides of the Atlantic have records.

The S&P 500 closed Tuesday at a new high of 6,129.58, up 0.24%. The Nasdaq Composite increased by 0.07% while the Dow Jones Industrial Average remained unchanged. Nevertheless, Meta’s stock ended its 20-day gaining run. After increasing by 0.32%, the regional Stoxx 600 index for Europe likewise recorded a record closing. With Lubawa rising 14% and Renk Group rising 2.7%, European military stocks kept rising.

Hope for a possible Intel split

Following reports that Taiwan Semiconductor Manufacturing and Broadcom are considering acquisitions that might split the American chipmaker, Intel’s stock jumped 16.1% on Tuesday. Intel’s stock ended the day at $27.39 after having its highest day since March 2020. After a 60% decline in 2024, its shares are now up about 31% this year after Tuesday’s gains. TSMC’s stock fell less than 0.6%, while Broadcom’s fell 1.9%.

Strict merger regulations were maintained.

Strict merger regulations were maintained.

On Tuesday, the Trump administration announced that it will continue to evaluate proposed corporate mergers using stringent standards that were implemented during the tenure of former US President Joe Biden. The decision is a setback for Wall Street, which had been expecting more acquisitions under a relaxed framework for analyzing proposed mergers, but a success for the anticorporate faction of the Trump administration, represented by Vice President JD Vance.

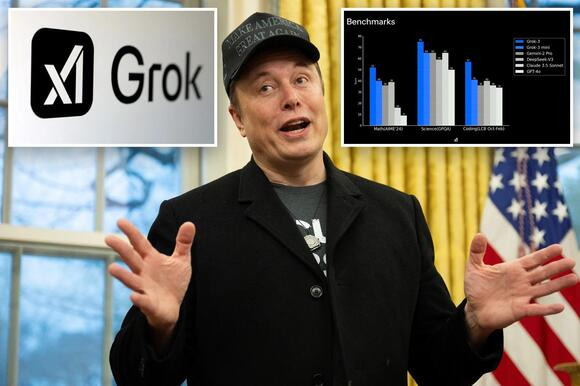

Grok 3 is launched by Musk’s xAI

Grok 3, Elon Musk’s xAI’s newest AI model, was unveiled on Tuesday. According to preliminary testing, it can outperform OpenAI and China’s DeepSeek. Additionally, the xAI team announced the release of “Deep Search,” a new tool that will function as a “next-generation search engine.”

Russia and the US meet in Saudi Arabia

The first official meeting between top U.S. and Russian diplomats since January 2022 took place Tuesday morning in Saudi Arabia when U.S. Secretary of State Marco Rubio met Russian Foreign Minister Sergei Lavrov. Both parties stressed that the discussions were preliminary. About Russia’s 2022 invasion of Ukraine, U.S. President Donald Trump stated that Ukraine “should never have started it” on the same day.

[PRO] Split over Europe’s superior performance over the U.S.

In January, the Stoxx 600 index increased 6.3%, which was significantly more than the S&P 500’s 2.7% rise. Up higher than the U.S. broad-based index month so far, the former’s superior performance continued into February. Although some analysts are hopeful that the trend will continue, others caution that due to a single market driver, “European investors may need to enjoy it while it lasts.”

Read More: Japan’s exports soar in January, driven by US auto sales